The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC]

![The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240302/16/original_95b8d9e2-7b13-4b01-8b3e-0f25aaa86b27.png)

Some Highlights

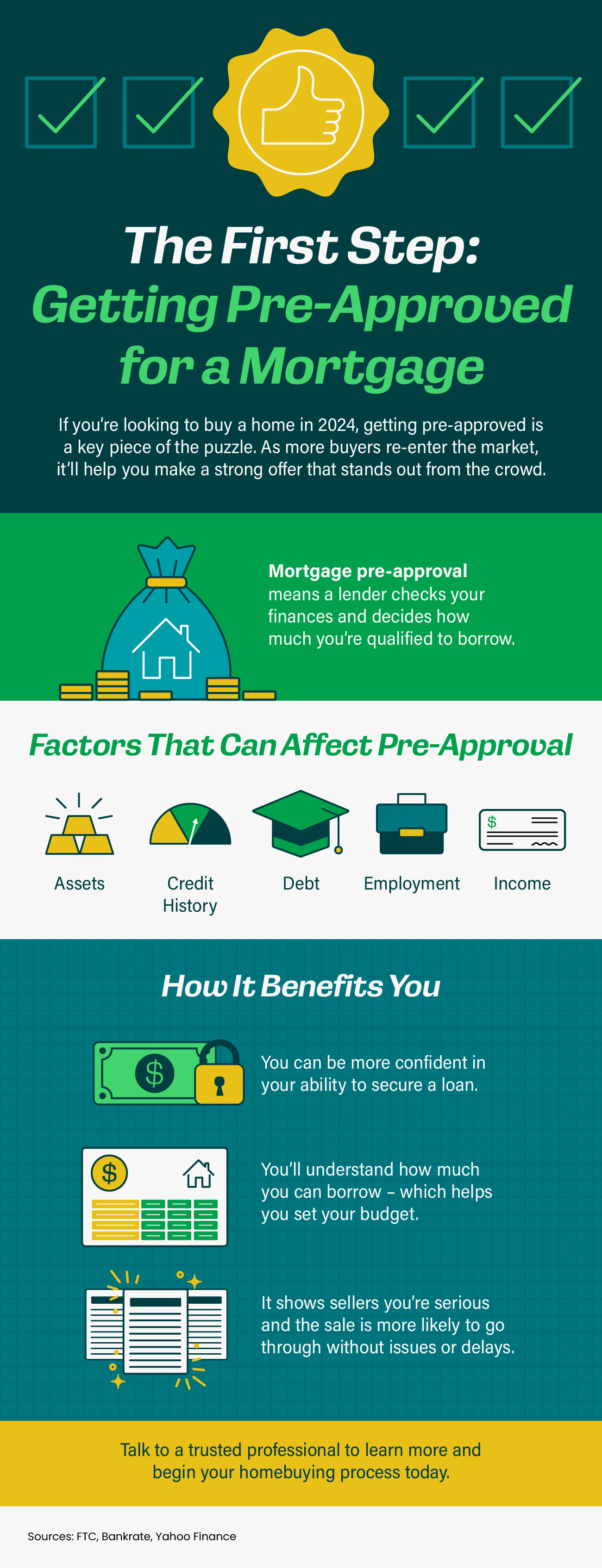

- If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow.

- As more buyers re-enter the market, it’ll help you make a strong offer that stands out from the crowd.

- Talk to a trusted professional to learn more and begin your homebuying process today.

Categories

Recent Posts

How To Get Your House Ready To Sell in 2025

Don’t Miss Out on the Growing Number of Down Payment Assistance Programs

What’s Behind Today’s Mortgage Rate Volatility?

If the Fed cut rates again, why are mortgage rates still high?

Is Wall Street Really Buying All the Homes?

Don’t Let These Two Concerns Hold You Back from Selling Your House

The Big Difference Between Renter and Homeowner Net Worth

Should You Sell Your House or Rent It Out?

More Homes, Slower Price Growth – What It Means for You as a Buyer

What’s Motivating Homeowners To Move Right Now